AI-Generated Summary

Context of the Housing Crisis

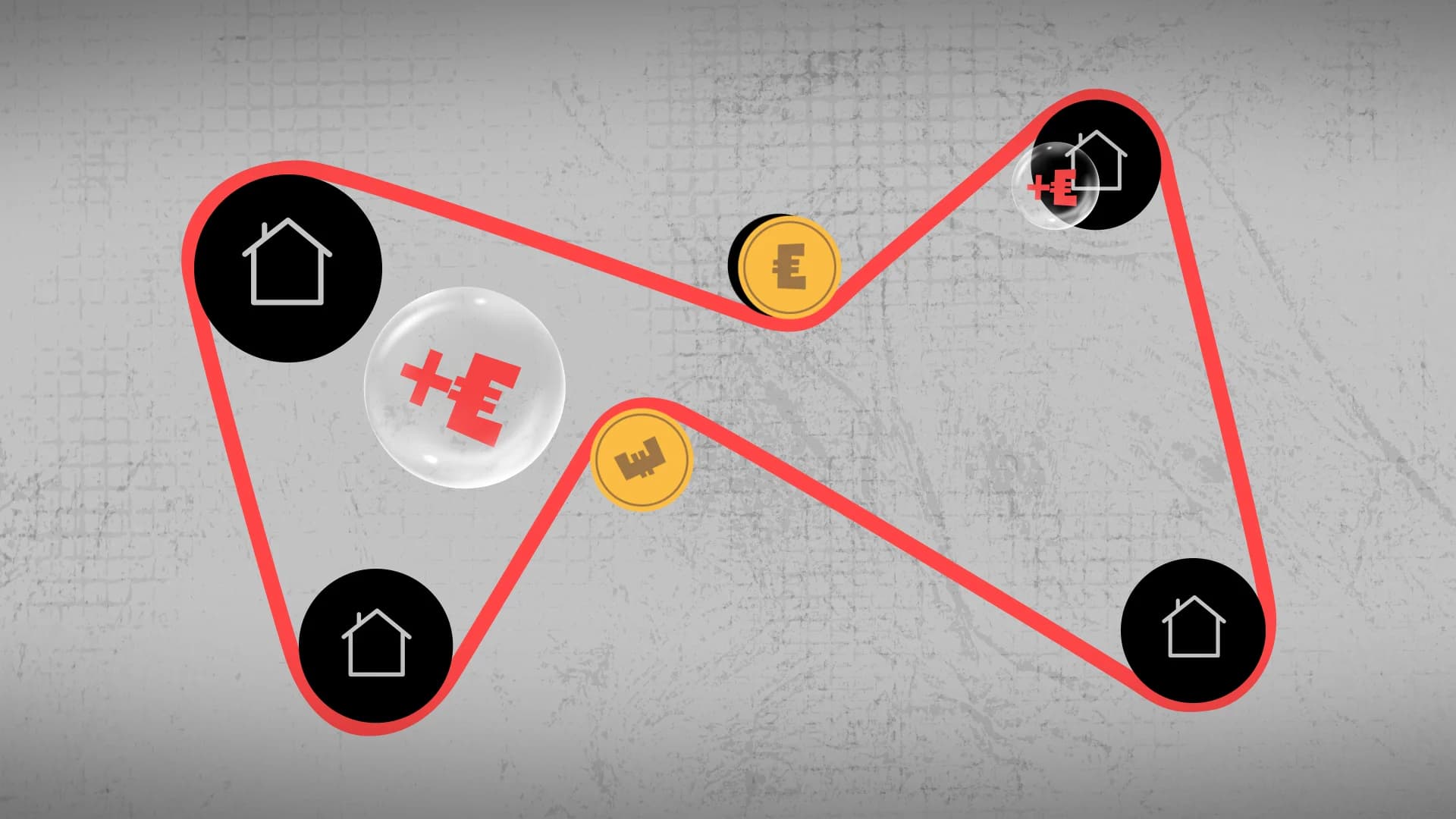

The rising prices in the European housing market have become a pressing issue, particularly impacting renters. Investigate Europe, a collaborative journalism initiative, authored this report, shedding light on the significant challenges faced by citizens amid favorable tax policies for real estate investors. The investigation highlights how these policies have lured billions into an overheated real estate market, creating a disparity between investors and average citizens.

Escalating House Prices

Between 2015 and 2021, average house prices in the EU-27 rose by nearly 40%, with only a few countries like Italy, Spain, and Cyprus seeing nominal declines. In contrast, Estonia experienced a staggering 2.5-fold increase in house prices over the decade. Countries such as Hungary, Luxembourg, Latvia, and Austria also reported house prices doubling, while Germany and Scandinavia witnessed significant increases despite lower growth in disposable incomes.

Rental Market Dynamics

While rents increased by approximately 8% during the same period, this growth closely matched cumulative inflation, meaning rents have remained relatively stable in real terms since 2015. The rental sector's inelastic nature allows for slower price adjustments compared to house prices, but further increases are anticipated as house prices continue to rise sharply.

Saving for Homeownership

The report reveals the extensive time required to save for a home in various European capitals. In cities like Prague, Bratislava, and Paris, it takes over 20 years on average wages to save for a 75m² apartment. Even in cities with shorter timelines like Dublin and Brussels, purchasing a property without loans remains a significant challenge. The time needed to save for a home has notably increased, with Budapest experiencing a rise from 6.3 years in 2012 to an estimated 18 years by 2022.

Homeownership vs. Renting

In many former socialist countries, homeownership levels exceed 90%, contrasting sharply with lower rates in western and northern Europe. The report indicates that while house prices are rising universally, the implications differ significantly across regions. In Eastern Europe, inheriting property can facilitate homeownership, unlike in the West, where higher debt levels complicate purchasing decisions.

Rent Affordability Issues

Despite minor increases in rent, many individuals find themselves unable to afford housing. Approximately 50% of market renters in the EU-27 spent over 40% of their income on housing in 2021, with Greece facing the most severe conditions—nearly 97% of renters in the country are overburdened. The report emphasizes that, although rents may appear affordable on average, they are disproportionately affecting low-income earners.

The Challenge of Rental Markets

Data indicates that in many countries, one-bedroom rentals are unaffordable for individuals earning a median wage. In cities like Brussels and Nicosia, renting a one-bedroom apartment consumes 41% of the median income, with some cities requiring more than an entire annual income. Even in more affordable locations, such as Vienna, the rental burden remains significant, underscoring the urgent need for sustainable housing solutions across Europe.