AI-Generated Summary

Context and Overview

The publication titled "Increase In Conversions Expected To Benefit European Office Market Recovery" is produced by AEW, a global real estate investment management firm. The author, Irène Fossé, provides an analysis of the European office market, focusing on the effects of advanced technologies, particularly AI, and the ongoing trends in office conversions. The report outlines the changing dynamics of office employment and market vacancy rates, especially in central business districts (CBDs).

Impact of AI on Office Employment

The report highlights the anticipated positive impact of Generative AI (GenAI) on office employment. As AI automates routine tasks, it is expected to create higher-value jobs, particularly in cities like London, Paris, and Frankfurt. While overall employment in the Eurozone is projected to peak at around 172 million in 2027, office employment is less affected by demographic challenges, with a significant increase in AI-related positions expected by 2040.

Office Vacancy Rates and Market Dynamics

Office vacancy rates have been on the rise, particularly in Q1 2025, where the average CBD vacancy rate reached 5.6%. The trend of bifurcation continues, with non-CBD submarkets showing higher vacancy rates. However, a decrease in overall vacancy to 7% is projected by 2029, driven by fewer new constructions and an increase in office conversions.

Rental Growth Projections

Average prime rental growth across European office markets is expected to reach 2.8% per annum from 2025 to 2029. In CBD submarkets, rental growth is forecasted at 3.5% per annum, slightly higher than the 3.3% for non-CBD areas. This indicates a potential broadening recovery in the office market, countering previous trends of high disparity between CBD and non-CBD rental rates.

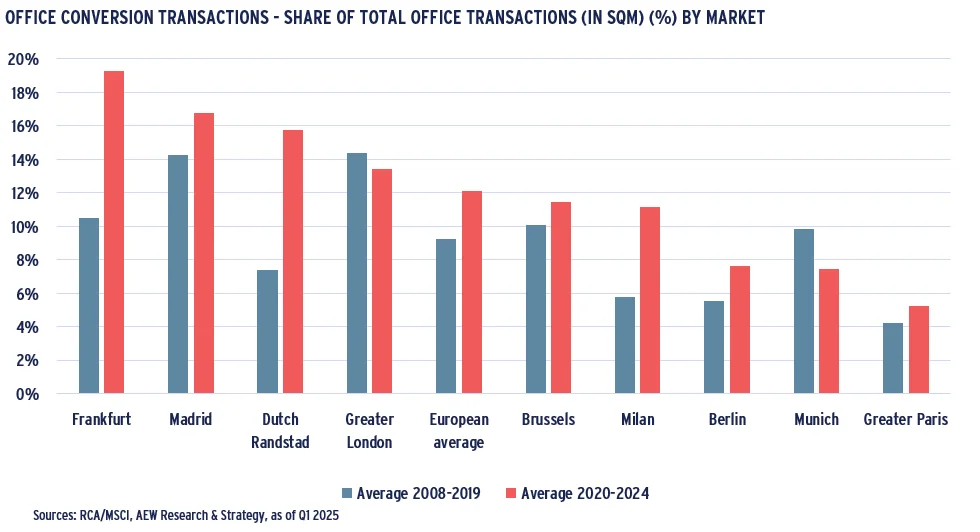

Increasing Office Conversions

The report notes that office conversions are becoming more prevalent, with over 30% of total office transactions in early 2025 aimed at conversions, a significant rise from previous years. Cities like Frankfurt and Madrid lead this trend, driven by high vacancy rates and regulatory adjustments that facilitate the repurposing of offices into residential or other uses.

Sustainability and Future Outlook

As concerns about carbon emissions grow, the report underscores the sustainability aspect of office conversions. Repurposing existing buildings is increasingly favored over demolition, aligning with environmental goals. The average total returns for European office markets are expected to reach 9.4% per annum, with non-CBD submarkets likely to outperform CBD markets due to higher current income yields.

Investment Sentiment and Market Liquidity

European investors are showing a more positive sentiment towards office investments compared to their U.S. counterparts, with over 40% expecting capital value increases. The report indicates a tightening yield spread between CBD and non-CBD markets, creating potential investment opportunities in non-CBD areas. Overall, the analysis provides a comprehensive view of the European office market's recovery trajectory, emphasizing the importance of AI, conversion trends, and sustainability in shaping the future of office spaces across the continent.