AI-Generated Summary

In the current landscape of European real estate, governments are increasingly offering substantial tax benefits to real estate investors and owners, a trend that transcends political differences among member states. Investigate Europe, a publisher focused on in-depth investigative journalism, has conducted an analysis revealing how these tax policies have substantial implications for housing affordability across Europe.

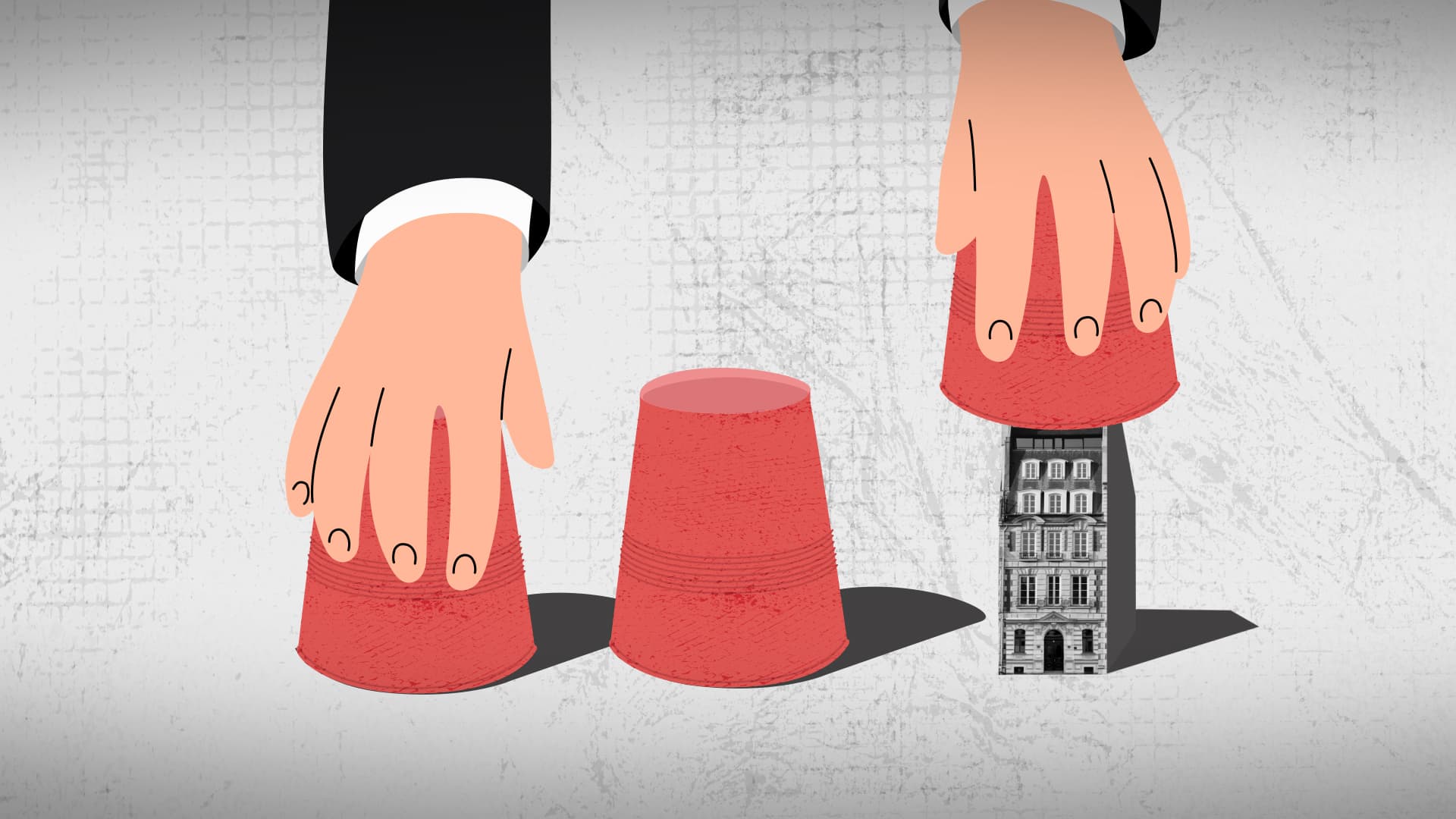

Tax Benefits and Real Estate Investment

The investigation highlights that several European countries, including Austria, Belgium, France, Germany, Greece, Hungary, Italy, Norway, Portugal, Spain, Sweden, and the UK, have tax regimes that favor certain real estate investments over other business sectors. This preferential treatment includes full exemptions on capital gains, reduced tax rates on rental income, and special tax guarantees for investment funds. Such policies lure billions of euros into an already overheated real estate market, exacerbating the housing crisis experienced by many citizens.

Under-Taxed Real Estate

Experts, including economists and tax professionals, have come to a consensus that real estate—both commercial and residential—is significantly under-taxed or entirely untaxed in most European countries. This lack of regulation allows for various tax avoidance schemes by real estate investors, leading to a misallocation of capital. Countries like Germany, Italy, Portugal, and Belgium are losing billions of euros due to these exemptions, which further complicates the economic landscape.

Impact on Housing Prices

The consequences of these tax privileges are dire. As capital is funneled into real estate, housing prices continue to rise, intensifying the struggle for affordable housing. Data indicates that in most EU countries, except for Italy and Malta, house prices have increased at rates surpassing both inflation and wage growth since 2010. The situation is mirrored in Norway and the UK, where the cost of living has also escalated alarmingly. In major cities such as Prague, Bratislava, and Paris, it could take over 20 years of average earnings to purchase a flat.

Human Stories and Government Accountability

Investigate Europe has also gathered first-hand accounts from individuals affected by the housing crisis, providing a human dimension to the statistics. The team confronted national governments regarding the inconsistencies within tax policies and the social costs these privileges impose on everyday citizens. The findings not only reveal the extent of the problem but also highlight the urgent need for policy reforms that prioritize sustainable housing solutions.

Further Reading and Related Investigations

The report is part of a broader investigation into the housing market's challenges, emphasizing the urgent need for transparency and accountability in government policies. It discusses various related topics, such as the commodification of housing, the impact of large investors on urban communities, and the ongoing issues of vacant properties across Europe. Through this investigation, Investigate Europe aims to shed light on critical economic policies affecting housing and to advocate for more equitable solutions that ensure sustainable living conditions for all citizens.