AI-Generated Summary

Context of the Investigation

Investigate Europe, a collective of journalists focused on uncovering issues affecting European societies, presents a critical analysis of how various European governments inflate housing prices through significant tax privileges for real estate investors and owners. The piece is authored by Paulo Pena, emphasizing the impact of these policies on housing affordability across the continent.

Tax Benefits for Real Estate Investors

European governments provide extensive tax advantages to real estate stakeholders, a trend prevalent across many member states regardless of political affiliation. Over recent months, Investigate Europe examined taxation structures and loopholes in multiple countries, revealing that these incentives attract billions of euros into an already heated real estate market.

Case Studies: Berlin and Milan

In Berlin, the sale of apartments previously owned by Harry Gerlach to Mähren AG raised concerns among residents about impending rent increases amidst a cost-of-living crisis. Under German law, heirs of large housing companies can avoid taxes if properties are held for a designated period. The sale generated €43 million, with no public commentary on the tax implications. In Milan, residents faced anxiety as properties controlled by the US asset management firm Apollo lacked tax obligations, leading to non-renewal of leases without prior notification. This situation left long-term tenants like Gianfranco Cerlienco fearing eviction as their contracts approached expiration.

The Rise of Housing Prices

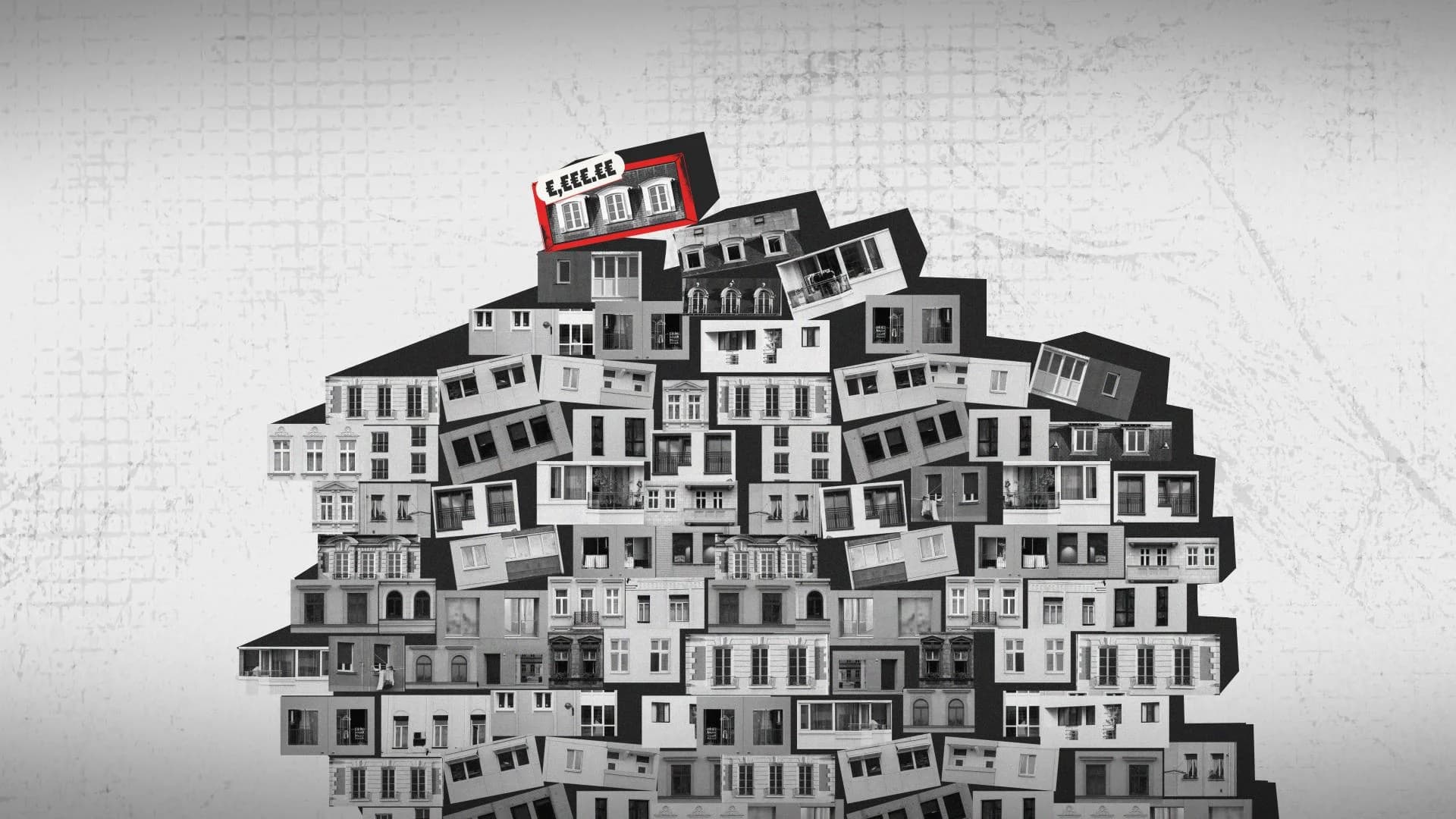

From Berlin to Paris, and London to Athens, citizens grapple with opaque ownership structures that contribute to inflated housing prices. Between 2010 and 2021, house prices in the EU surged nearly 40%, making the quest for affordable housing increasingly difficult. The rapid transformation of urban areas is largely driven by real estate conglomerates, thanks to favorable taxation policies that enable their expansion.

Economic Analysis of Tax Privileges

Investigate Europe’s findings indicate that various countries, including Germany, France, and Greece, employ tax regimes that favor real estate investments. Common benefits include capital gains exemptions and low rental income taxes, which have led real estate funds in the Eurozone to reach a staggering €1 trillion, a significant increase from €350 billion in 2010. Experts argue that these tax reliefs inflate housing prices, exacerbating the ongoing housing crisis.

Citizens Overburdened by Housing Costs

The rising cost of housing has forced many Europeans to allocate a substantial portion of their disposable incomes to rent or mortgages, leading to a situation where households spend over 40% of their income on housing. The EU Commissioner for Jobs and Social Rights, Nicolas Schmit, acknowledges this crisis, calling for increased public and private investment in affordable housing.

Government Inertia and Transparency Issues

Despite the visible challenges faced by citizens, governments show little inclination to reform tax privileges that benefit real estate investors. A November ruling by the European Court of Justice limited public access to beneficial ownership registries, complicating efforts to track property ownership and reinforcing the influence of tax havens.

The Need for Change

The report highlights a growing consensus among economists and civil society that tax policies favoring real estate must be re-evaluated. Investigate Europe concludes that the current taxation framework promotes a housing market that prioritizes investor profit over citizen welfare, emphasizing the urgent need for reforms to address the growing housing inequality across Europe.