AI-Generated Summary

Context and Overview

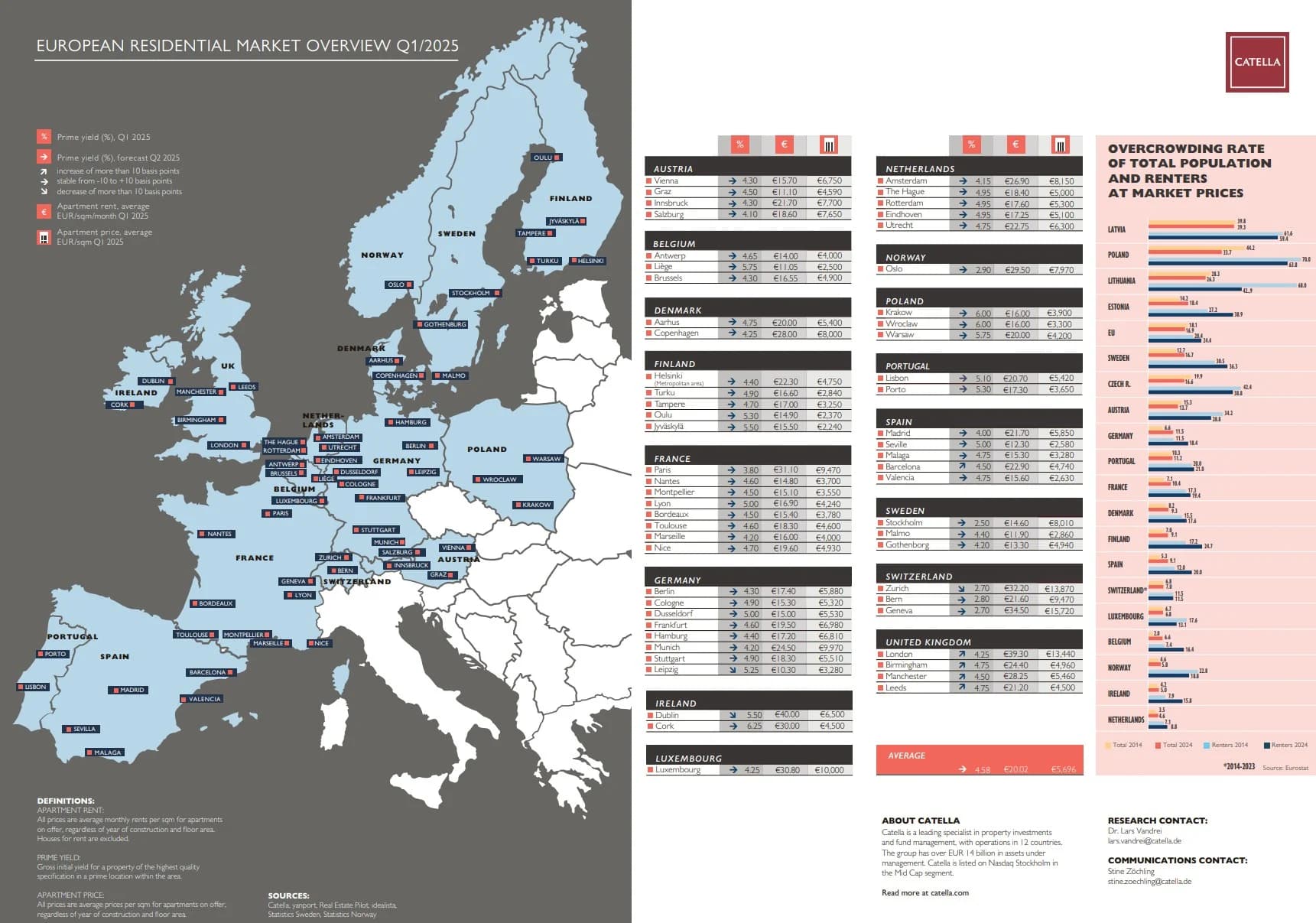

Catella Investment Management (CIM), an independent real estate investment advisor based in Stockholm, has released a report highlighting the worsening housing shortage in Europe. The report emphasizes the pressing issues in the rental market, focusing on overcrowding, rising rental prices, and the fluctuating landscape of property purchase prices across various European cities. CIM manages approximately EUR 10 billion in assets and offers comprehensive advisory services across 15 European countries.

Rental Market Trends

In the first quarter of 2025, rental prices in Europe have seen a significant upward trend, with 48 out of 59 cities analysed reporting increases. The unweighted average rental price now stands at €20.02 per square meter per month, reflecting a 2.4% rise since the third quarter of 2024. Dublin leads the pack with the highest average rent at €40.00/m², followed by London at €39.30/m² and Geneva at €34.50/m². Conversely, Leipzig, Liège, and Graz offer the lowest rents, priced at €10.30/m², €11.05/m², and €11.10/m², respectively.

Property Purchase Prices

The report also notes a mixed performance in property purchase prices. Prices for condominiums rose in 31 out of the 59 cities studied, with an average price across Europe at €5,696/m², marking a 0.9% increase since the previous quarter. Geneva remains the priciest city for property at €15,720/m², followed by Zurich and London. Conversely, the most affordable property prices are found in Finland's Jyväskylä and Oulu, with prices of €2,240/m² and €2,370/m², respectively. Notably, the most significant price increases were observed in Copenhagen, Gothenburg, and Madrid.

Rental Yield Insights

The average prime yield for multi-family residential properties is currently at 4.58%, remaining stable since the last quarter of 2024. The lowest yields are found in Stockholm (2.50%) and the Swiss cities of Zurich and Geneva (2.70%), while higher yields can be achieved in Cork (6.25%) and various Polish cities, indicating a diverse investment landscape throughout Europe. 🇩🇪 Focus on Germany Germany demonstrates strong rental growth, with all cities analysed reporting increases. Munich leads as the most expensive rental market at €24.50/m², followed by Frankfurt and Stuttgart. In terms of ownership, Munich also tops the list with an average price of €9,970/m². Notably, Leipzig remains the most affordable option among Germany's largest cities, with an average price of €3,280/m² and a prime yield of 5.25%.

Rising Overcrowding

A special focus in this report is on the issue of overcrowding in European households. The proportion of individuals living in overcrowded conditions has increased among renters, rising from 20.4% in 2014 to 24.4% in 2024 across the EU. This issue is particularly severe in Northern and Eastern Europe, while Western and Southern Europe also show significant increases. In Germany, 18.4% of renters now live in overcrowded conditions, a notable increase from 11.5% a decade ago. In conclusion, the Catella report highlights the critical challenges facing the European housing market, emphasizing the need for sustainable solutions to address rising rental prices and increasing overcrowding. The findings call for urgent attention to ensure that housing remains accessible and livable for all citizens across Europe.