AI-Generated Summary

The written report by the Federal Ministry of Housing, Urban Development, and Construction (BMWSB) addresses the issue of vacant office spaces across Germany, highlighting the significant trends and challenges faced in the current real estate market.

Current Vacancy Trends

Since reaching a low of approximately 2% in 2019, the vacancy rate for office spaces in Germany has been steadily increasing. The COVID-19 pandemic, along with the rise of remote work and flexible working models, has fundamentally altered the demand for office space. By 2024, the vacancy rate across 127 key German office markets had reached 5.6%, representing 11 million square meters of vacant space. This marks an increase of 80 basis points from the previous year. Major cities, particularly the "Top 7" (Berlin, Hamburg, Munich, Cologne, Frankfurt, Stuttgart, and Düsseldorf), are experiencing rising vacancies due to high completion rates of new buildings amid moderate demand.

Regional Disparities

The report notes that the increase in vacancies is not limited to major cities but is also expanding to B- and C-cities, particularly those with industrial or administrative profiles. These areas are seeing consolidations of office spaces and large new constructions coincide with weaker demand, leading to higher vacancy rates. In 2024, the vacancy rate was reported at 5% for B-cities and 4% for C-cities. The current market phase is characterized by a cleaning process, where structural factors like changing work models and sustainability criteria play an increasingly crucial role.

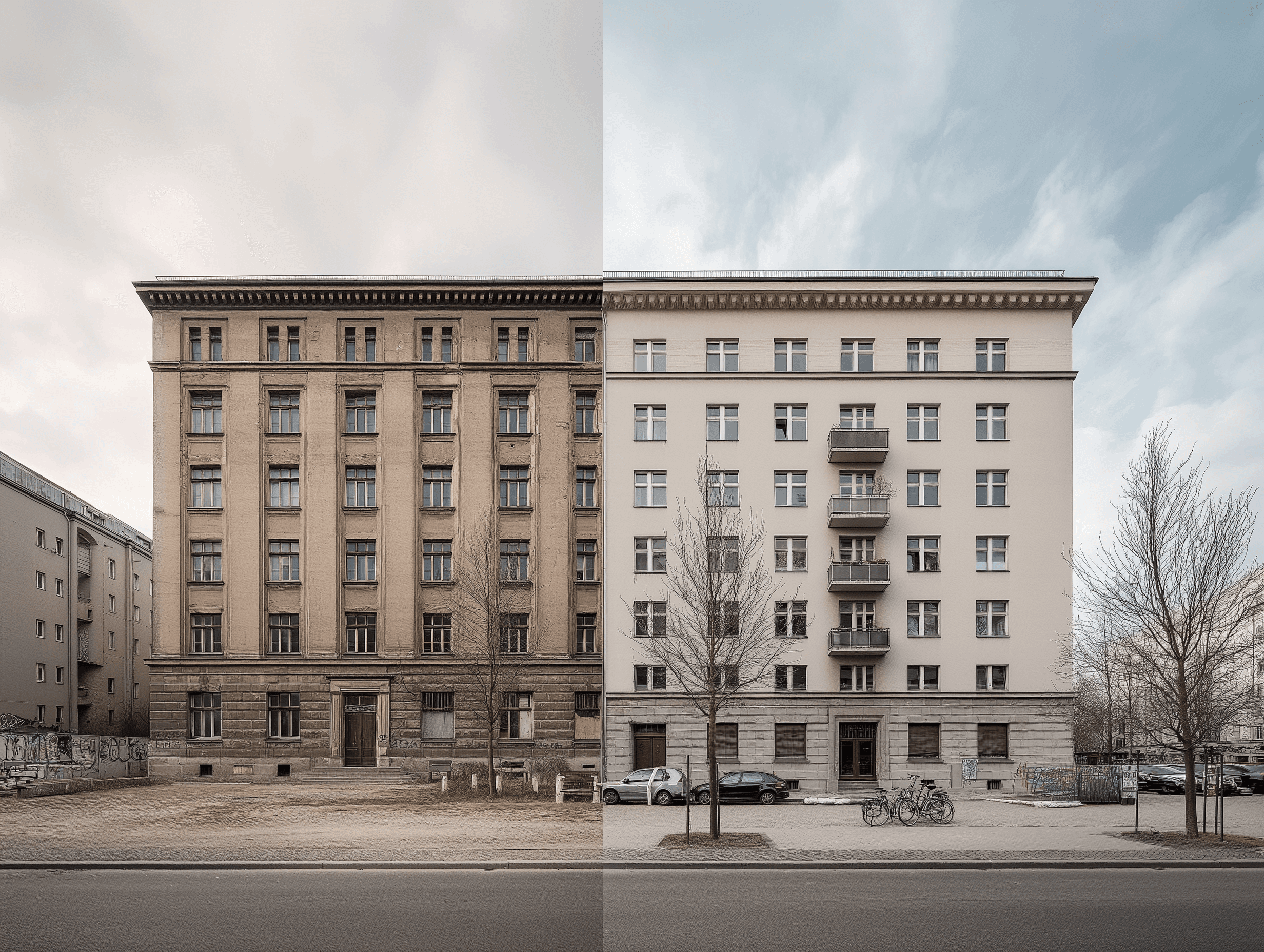

Transitioning Commercial to Residential Spaces

In response to the growing number of vacant office buildings, the German government is looking to support owners in converting these non-residential buildings into residential spaces. The "Commercial to Residential" initiative aims to provide financial incentives for transforming unused office spaces into homes, addressing the significant housing shortage. A budget of 360 million euros has been allocated for this purpose in the 2026 economic plan, with a focus on enhancing building quality and sustainability.

Social Housing Support

The report discusses the role of social housing promotion in facilitating the conversion of commercial properties into social housing. The specific funding conditions depend on the regulations set by the states, while the federal government provides financial aid. Additionally, the concept of employee housing is highlighted as a way to activate previously unavailable potential for residential development.

Special Depreciation for New Rental Housing

The potential to utilize special depreciation for new rental housing activation is contingent upon the scale of the improvements made and whether new housing units are genuinely created. This includes converting existing commercial spaces into residential units, provided they meet legal standards.

Accelerating Housing Development

The report outlines measures to expedite housing construction, including allowing modifications to existing buildings and the conversion of office vacancies into residential units. This initiative is part of broader efforts to address urban vacancies and promote sustainable development.

Urban Development Support

Since the 1970s, federal and state programs have provided financial support for city development and renewal efforts. Various initiatives allow for the promotion of repurposed office buildings if their future use aligns with urban development goals. The federal government emphasizes the importance of these projects in strengthening urban areas as residential and economic hubs.

Addressing Inner-City Vacancies

The Ministry has also focused on strategies to manage inner-city office vacancies, recognizing the impact of vacant properties on urban identity and foot traffic. The publication of a guide on handling large urban properties aims to assist municipalities in combating vacancy issues and exploring options for repurposing office spaces into residential units.