AI-Generated Summary

The Europeans, a podcast focused on European affairs, produced this episode as part of a series examining housing policies across Europe. The host, Katz Laszlo, aims to shed light on the complexities of the housing crisis while challenging common misconceptions about the factors contributing to it.

Context and Myths

In the first part of this series, examples from Vienna, Finland, and Paris highlighted effective housing policies. However, in this second part, the podcast seeks to debunk prevalent myths surrounding housing crises, such as the misconception that asylum seekers are responsible for housing shortages. Contrary to popular belief, research indicates that deregulation of renters' rights and wealth inequality are the primary drivers of the housing crisis in Europe.

The Building Debate

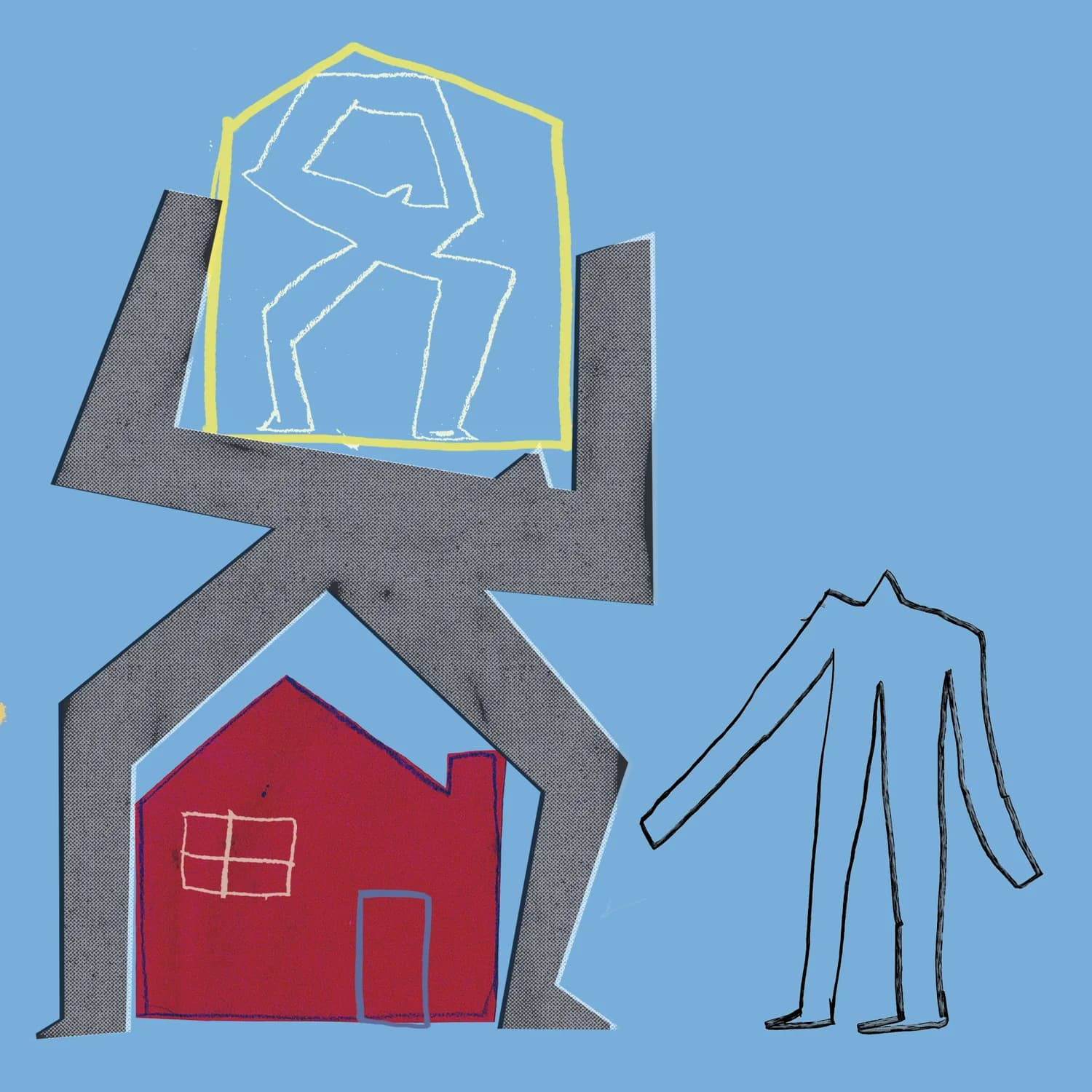

A common assumption is that the housing crisis is simply due to a lack of available homes. While building new homes is essential, many European cities face constraints on space and resources. The podcast notes that building projects often fall through due to rising costs and lack of investment, suggesting that the real issue may not be scarcity but rather affordability. Even in capital cities, there are significant numbers of empty homes juxtaposed against rising homelessness.

Wealth Inequality

The podcast reveals stark wealth disparities in the housing market, particularly in the Netherlands, where homeowners are reportedly 90 times richer than renters. Renters typically allocate 30-40% of their income to housing costs, while homeowners pay around 10%. This disparity is largely attributed to favorable tax policies for homeowners, such as the mortgage interest tax deduction, which significantly benefits the wealthy and exacerbates the housing crisis.

Policy Failures

The podcast discusses how past policies, especially those implemented after the 2008 financial crisis, have favored homeowners, allowing them to accumulate wealth while renters face increasing challenges. The former Dutch housing minister acknowledged that deregulating the rental sector was intended to improve investment conditions but ultimately led to more inequalities in housing access.

Exploring Solutions

Katz emphasizes the need for reformed housing tax policies that would help redistribute wealth and address the root causes of the housing crisis. The podcast highlights the potential of housing tax reforms to mitigate disparities between homeowners and renters, creating long-term solutions for affordability.

The Role of Shame

Interestingly, the podcast explores the emotional aspects of the housing crisis, particularly the shame associated with inadequate housing. Many renters feel personal responsibility for their situations, which can stifle public discourse on systemic issues. This emotional barrier complicates efforts to advocate for necessary policy changes, as those affected often feel isolated in their struggles.

A Call for Change

Finally, the episode concludes with a call to action, suggesting that the urgency of the housing crisis may provide an opportunity for transformative change. The podcast argues that addressing housing policies and the underlying economic inequalities could lead to a more equitable future for all citizens across Europe.